In healthy companies that are actively investing in their businesses, this number will often be in the negative.

CASH FLOW VS PROFIT DOWNLOAD

DOWNLOAD NOWĬash flow refers to the net balance of cash moving into and out of a business at a specific point in time.Ĭash is constantly moving into and out of a business.

CASH FLOW VS PROFIT FREE

Here’s everything you need to know about cash flow, profit, and the difference between the two concepts.įree E-Book: A Manager's Guide to Finance & AccountingĪccess your free e-book today.

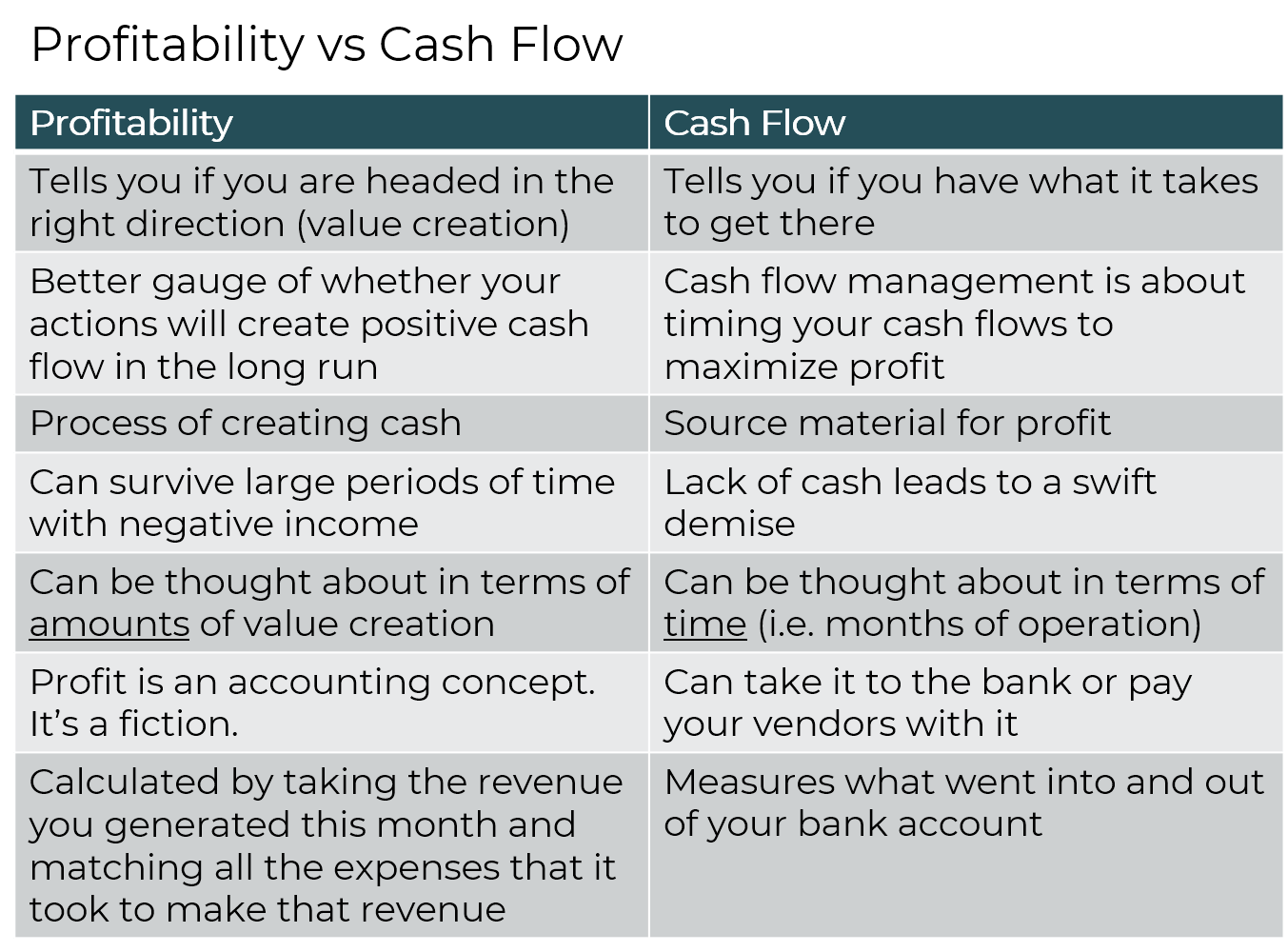

For entrepreneurs and business owners, understanding the relationship between the terms can inform important business decisions, including the best way to pursue growth. Cash flow and profit aren't the same things, and it’s critical to understand the difference between them to make key decisions regarding a business’s performance and financial health.įor investors, understanding the difference between profit and cash flow makes it easier to know whether a profitable company is a good, long-term investment based on its ability to remain solvent in times of economic crisis. Yet, it isn’t uncommon for those new to finance and accounting to occasionally confuse the two terms. Cash flow and profit are essential financial metrics in business.

0 kommentar(er)

0 kommentar(er)